Filling out a self assessment tax return might appear intimidating, yet with proper preparation, organization, and a clear grasp of the requested information, the process is far less complex than it appears. Well at least that’s what my experience was. Ensure you comprehend the form thoroughly to accurately submit it.

Table of Contents

Do I Need To Fill in a Self Assessment Tax Return?

Yes, you need to fill it in for following situations:

- your self-employment income was more than £1,000 (before taking off anything you can claim tax relief on)

- your income from renting out property was more than £2,500 (you’ll need to contact HMRC if it was between £1,000 and £2,500)

- you earned more than £2,500 in untaxed income, for example from tips or commission

- your income from savings or investments was £10,000 or more before tax

- you need to pay Capital Gains Tax on profits from selling things like shares or a second home

- you’re a director of a company (unless it was a non-profit organisation, such as a charity)

- you, or your partner’s, income was over £50,000 and you’re claiming Child Benefit

- you have income from abroad that you need to pay tax on, or you live abroad but have an income in the UK

- your taxable income was over £100,000

- if you earned over £50,000 in the 2022/23 tax year and make pension contributions you might have to complete an assessment to claim back the extra tax relief you’re owed

- you’re a trustee of a trust or registered pension scheme

- your State Pension was your only source of income and was more than your personal allowance

- you received a P800 from HMRC saying you didn’t pay enough tax last year.

- You can also fill in a Self Assessment tax return if you want to make voluntary Class 2 National Insurance contributions. This will help you qualify for benefits such as the State Pension.

You usually don’t need to fill in a Self Assessment tax return if you’re an employee who has paid tax through the Pay As You Earn (PAYE) system. This is unless you earned over £100,000.

How to Register for a Self Assessment Tax Return

In case you’re new to submitting a tax return, the initial step involves registering for Self Assessment under the online portal. Depending on whether you’re self-employed or you should need to declare some income, are different methods of registration available.

When you’ve registered, you’ll be sent your Unique Taxpayer Reference (UTR).

If you want to submit your Self Assessment form online, you’ll then need to set up a Government Gateway account. To do this, follow the instructions in the letter containing your UTR.

When you’ve set up the account, you’ll get an activation code in the post. You’ll then need to complete the set-up of your Gateway account.

If you’ve submitted Self Assessment tax returns before, you’ll need your old UTR to register and set up the account.

It’s best to make sure you can access your Gateway account before you try to submit your Self Assessment. This saves time if, for any reason, you can’t log in.

What Are the Self Assessment Deadlines?

Tax returns are based on tax years rather than calendar years and are submitted retrospectively. To illustrate, let’s consider the 2022/23 tax year, spanning from 6 April 2022 to 5 April 2023. During this period, you would need to:

- Register for Self Assessment by 5 October 2023 if you’re a first-time filer.

- Submit your return by 31 October 2023 at midnight if you’re opting for a paper tax return.

- Submit your return by 31 January 2024 at midnight if you’re filing online.

- Settle the owed tax by 31 January 2024 at midnight.

- Failure to meet any of these deadlines might result in penalty charges and accrued interest for delayed payments.

How to Fill In a Self Assessment Tax Return

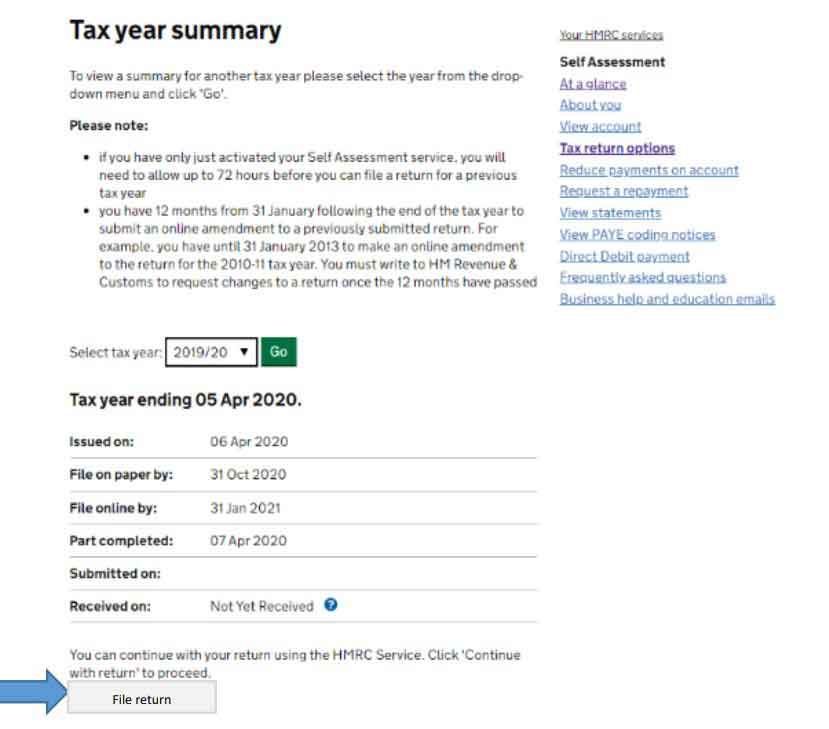

When you enter the Self Assessment part of the HMRC website, you are likely to start on a screen like this, where you can select which tax year you are filing your return for. Pease select the appropriate tax year. Once you have done this, click on the ‘file return’ button.

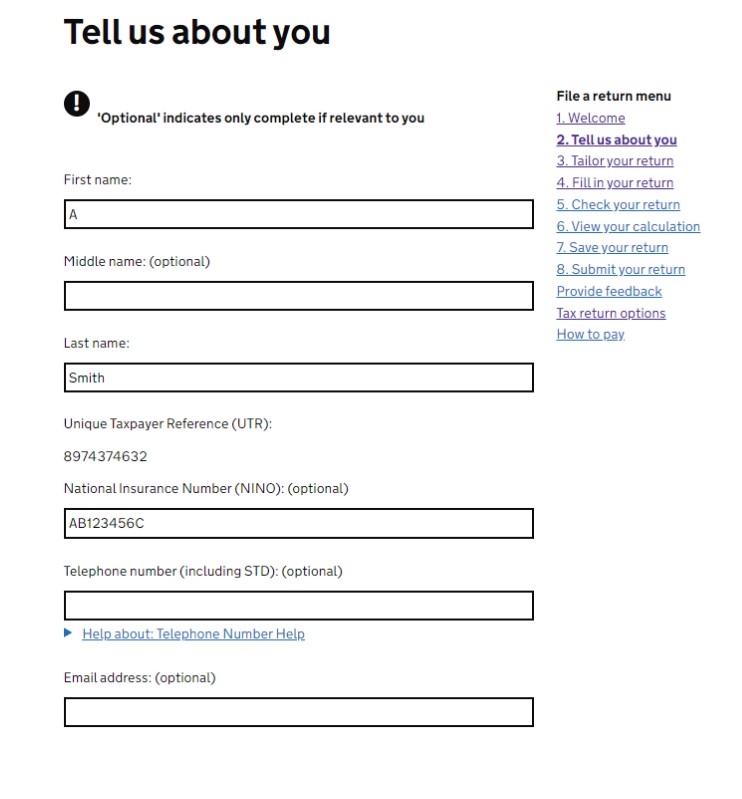

This section shows what information is currently saved about you – you can update anything that is incorrect. The ‘tell us about you’ section of the tax return should be reviewed and updated where appropriate. Once you have reviewed the necessary information, click ‘Save and continue’. The information provided in this image is for illustration only.

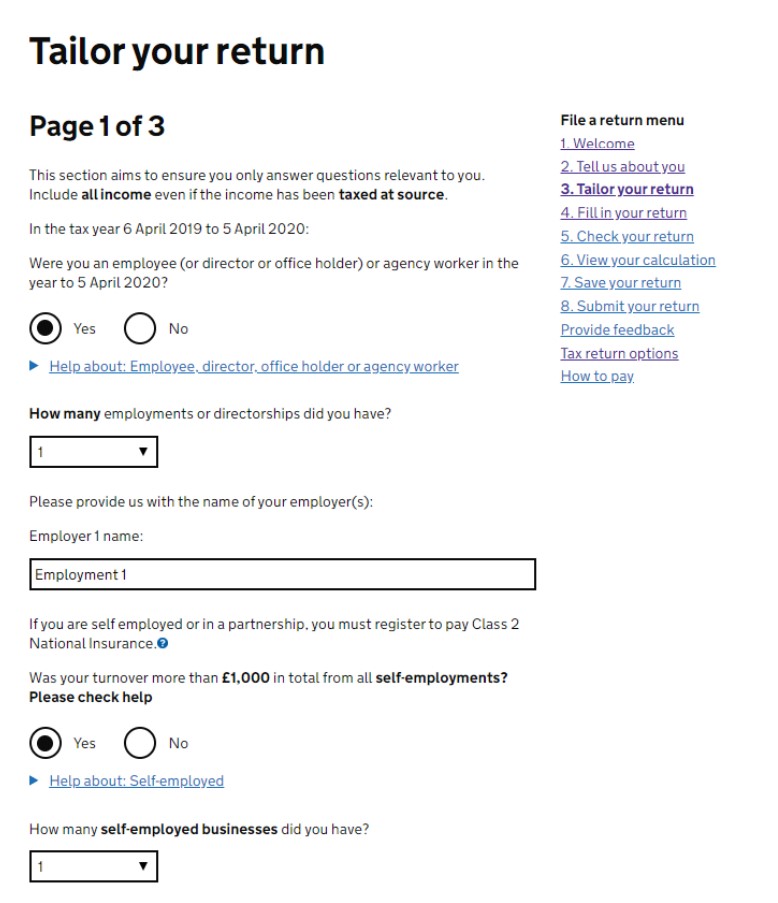

In section 3, you will see a list of question to “tailor your return” are 3 pages you will need to fill in. This is a crucial step as it allows you to select the type of income you wish to report to HMRC. This means that your online form will be personal to you and you don’t need to work through lots of unnecessary questions.

The information provided in this image is for illustration only. Go through the questions selecting an answer for each. When finished you can save then click on next.

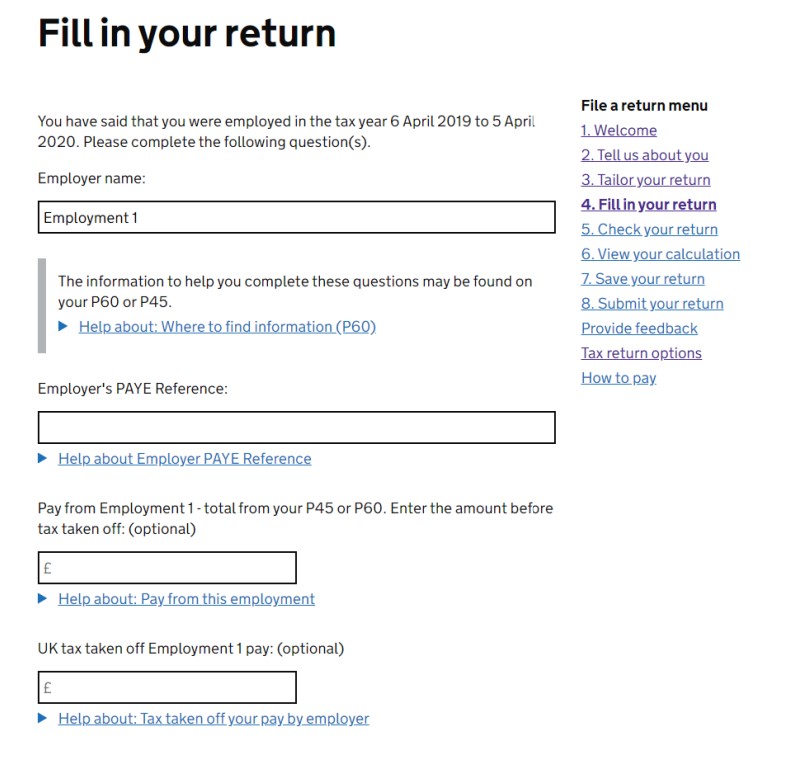

On the next screen you will see a further reminder of the information you should have to hand before progressing. Yours may appear slightly different to this. When you are ready to continue, click on ‘Next’.

The next stages of your tax return will be specific to your own, personal circumstances. Below I’ve provided some examples of the sections you may need to complete. Again, should be tailored to your needs. You will have a series of pages in which you need to tell HMRC about any income sources you may have: state pension, private pension, foreign income, oversea pension, UK interest income, dividend income and so on.

Completing your tax return for Employment Income. You should use your P60 or P45 to complete this age. You will need to include the Employer’s PAYE reference. This is on your payslip and P60 and P45. Do not forget to include the tax deducted from your pay.

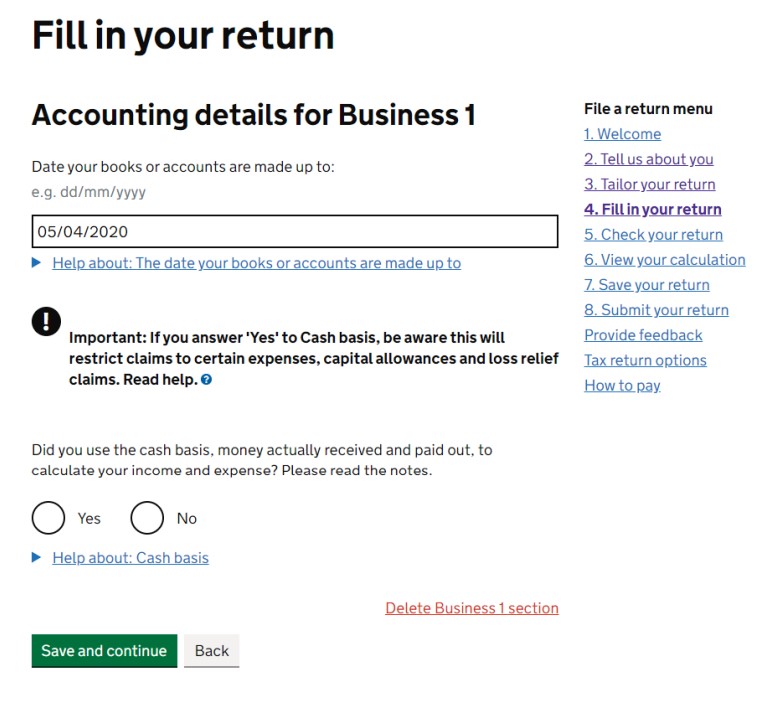

Now, we are getting to the Self-Employment bit. Completing your tax return for Self-Employment income.

You will need to have your self-employment income and expenses to hand to complete this section.

Special tax rules apply to a number of trades and professions e.g. foster carer or barrister, so these need to be ticked ONLY if they apply to you. The system lists a number of situations and you may wish to click on the information symbol to help you to check if any of these apply in your case.

Tick the box next to any that apply to you, or leave them blank and select ‘None of these apply’ at the bottom of the page.

Once you have made your selection, click ‘save and continue’ at the bottom of the pages.

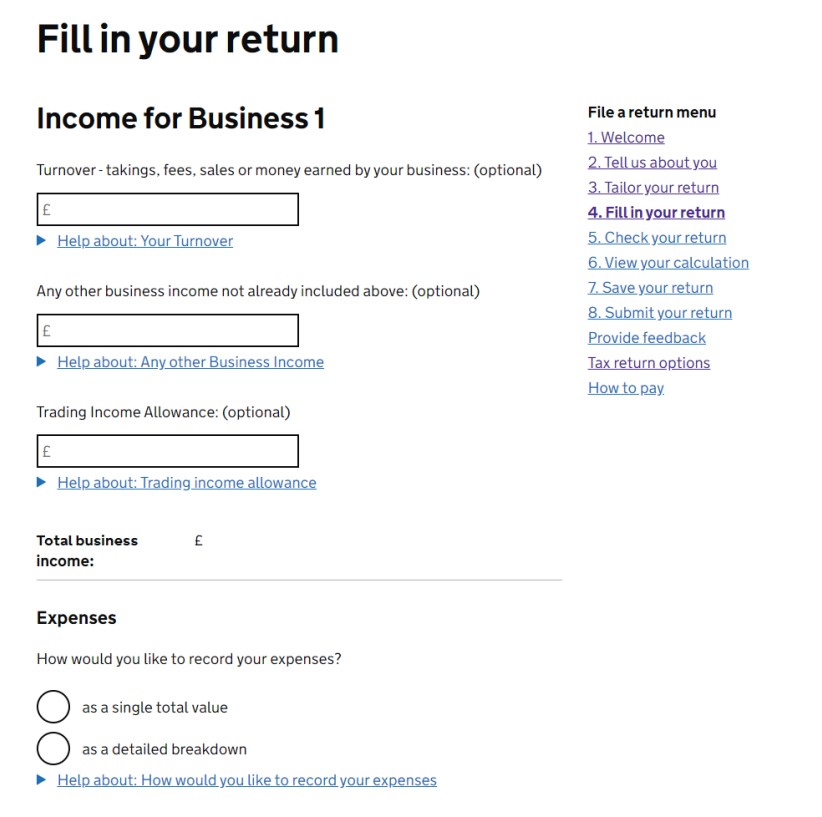

Continuing to the next screen, you are asked to type in your income and expenditure details. Turnover is another word for sales or income. Expenses can be entered as a single figure if the turnover is below the VAT threshold of £85k.

Onto the next screen and Capital Allowances may be available if you have incurred capital expenditure. The Annual Investment Allowance is a type of Capital Allowance.

You may wish to click on the information symbol or check HMRC’s website Capital Allowances. Also, on the next couple of screens you are going to be asked about tax adjustments and trading losses. If you need help understanding what is required here, you may need an accountant.

On the next screen, you will need to select whether you are exempt from paying Class 4 NIC (National Insurance). To help you understand this, you will need to read the list in the red box and only select “yes” if any of the points apply to you.

On the next screen, you will be shown how much Class 2 NIC (National Insurance) is due. This figure can sometimes be filled in already, but if not you can select the ‘Recalculate’ button to retrieve the figure.

If the figure is incorrect you can select ’Update your self employment detail’ this will show you the information HMRC have that may need to be amended. Once amended you will need to return to

this page and select ‘Recalculate’ to retrieve a new figure.

If your profits are less than small profits threshold for 2018/19 this is £6,205. You can pay voluntary Class 2 NICs.

When you have completed your specific income information, you will arrive at this screen, where you will be provided with a figure for any tax that was underpaid in previous years. If this figure is zero and/or is correct, select “yes” and continue. If the figure is incorrect, select “no”. The figure provided is for illustration purposes only.

Similar you will go through overpaid tax for this year, and due a refund, you can select who receives this.

On the next screen you are asked if you would like any tax that you owe to be collected through your tax

code in the next financial year. This only applies if the amount owed is below £3,000. If this applies to you, select “yes” in the top box.

In the second box, you can also select if you want any tax that you are likely to owe in the current tax year to be taken through your tax code.

In section 5 of the return, you get the opportunity to check the information you have provided and go back and change anything that is incorrect. Just click on each section in turn to check it.

Section 6 shows you the amount of tax you owe. You might wish simply to do a check or a calculation on paper and compare that calculation to the amount on the return. The figures provided are for illustration purpose only.

You can view and print and save your full calculation at this stage and/or go back to section 3 to make changes or additions. Just click on the relevant link on this screen to do so, or else if you are happy with your calculation on screen, click “Next” to continue.

Onto section 7 now, and here you can view, print and/or save a copy of your return to your own computer. It is recommended that you do save your return so that you have a copy of it in case you need to make any changes, or check what you have submitted at a later date.

An HTML copy of your return will contain the text of your return only. A PDF copy will look like the paper version of the Self Assessment form. View both to see which you would prefer (both can be saved/printed if you like).

In section 8 you are asked to tick a box to confirm that you believe the information in your return is correct.

You might need to re-enter your sign in details before submitting the tax return. This is your 12 digit Government Gateway number and the password you chose previously.

Paying Your Self Assessment Tax Bill

When you’ve submitted your Self Assessment tax return, you’ll be told how much tax and — if you’re self-employed — National Insurance contributions you’ll need to pay.

- When do you need to pay? The deadline is 31 of January.

- Can I pay my tax bill in instalments? Yes, you can make payments in instalments. However, these payments serve as a prepayment toward your upcoming tax liability. You have the option to establish a budget payment plan via your online account, enabling you to determine the weekly or monthly amount you wish to contribute.

- How can you pay your bill? There are many ways to pay your Self Assessment tax bill. But the length of time depends on which method you choose. I would go for online baking or paying using a debit/credit card.

- What happens if you miss the deadline? If you miss the deadline to register, submit your return or pay your bill – you’ll get a penalty. If you’re up to three months late filing or paying tax, there’s a penalty of £100. If it’s later than this, the penalty will be more. You can appeal if you have a reasonable excuse.